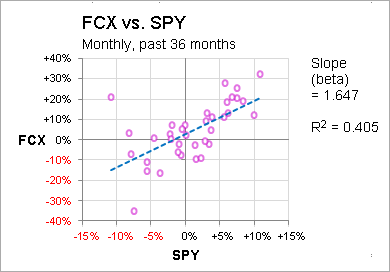

Beta is calculated as the line of best fit on a graph of market returns vs. Most Important Download Beta Calculation Excel Template.

Linear Regression Finding Alpha And Beta Investment Cache

Calculate Stock Beta With Excel

Beta Formula Calculator For Beta Formula With Excel Template

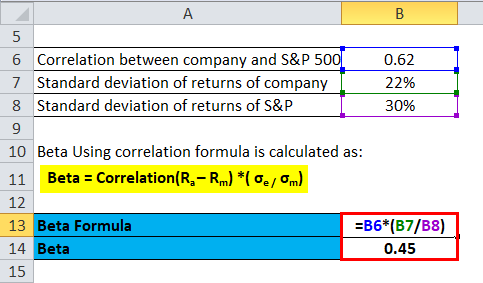

The formula for calculating Beta of a stock is.

Calculating beta of a stock using regression. Calculating Beta. A NeweyWest estimator is used in statistics and econometrics to provide an estimate of the covariance matrix of the parameters of a regression-type model when this model is applied in situations where the standard assumptions of regression analysis do not apply. At a lower price despite the rise in the stocks beta.

Beta_j is the effect on z of a one unit change in regressor X_j holding constant all other k-1 regressors. The order of an autoregression is the number of immediately preceding values in the series that are used to predict the value at the present time. We give anonymity and confidentiality a first priority when it comes to dealing with clients personal information.

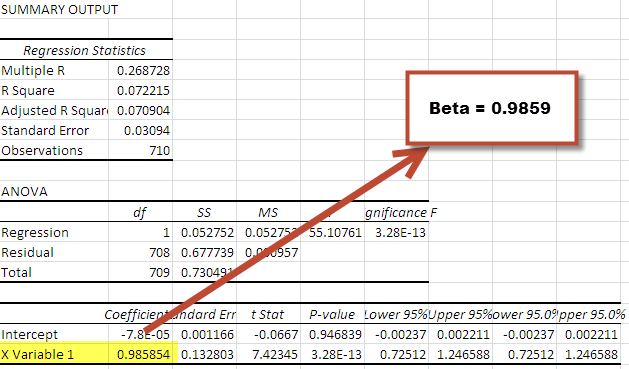

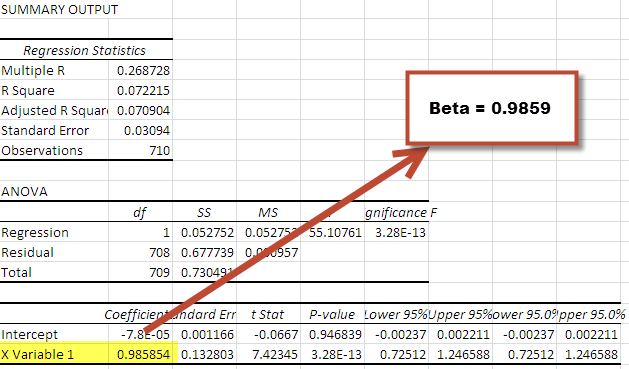

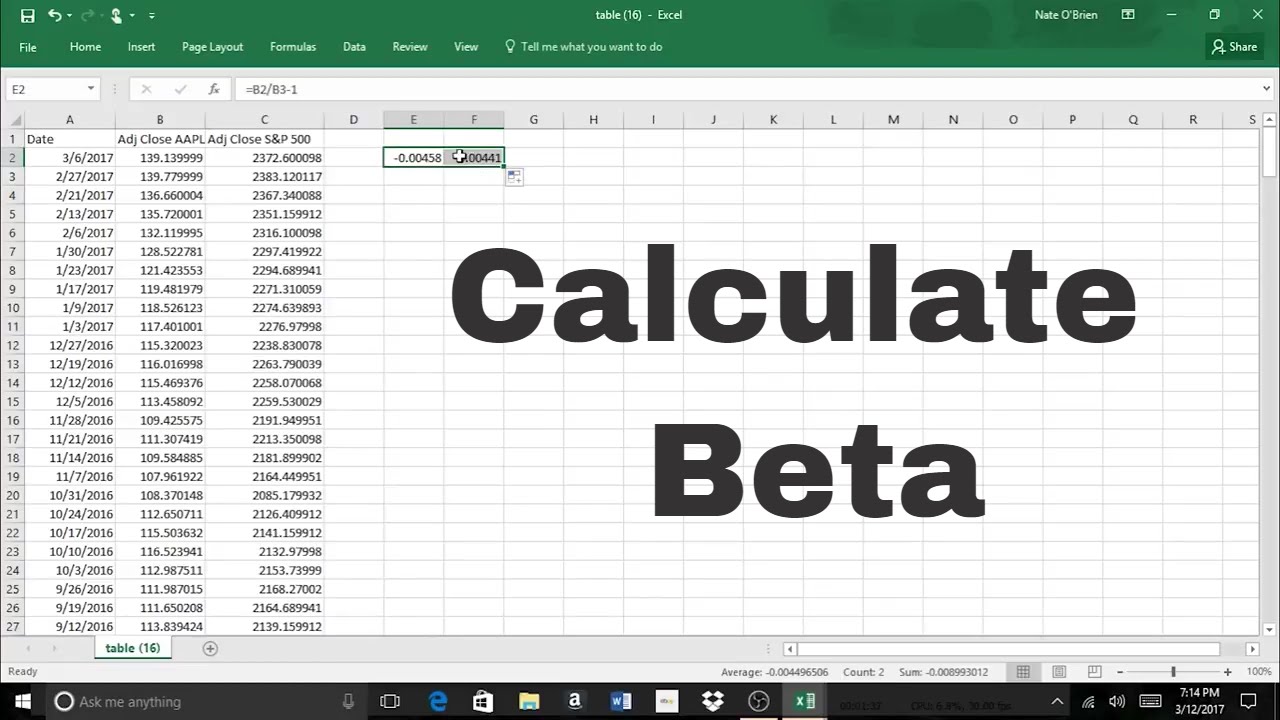

By using it investors can get a profitable return from the year 2019. Obtain and download weekly closing stock prices adjusted for dividends and splits for a period of two years should finish at same date as Bloombergs Beta calculation in this case February 27th 2014. Regression is used in finance to measure a stocks Beta volatility of returns compared to the overall market.

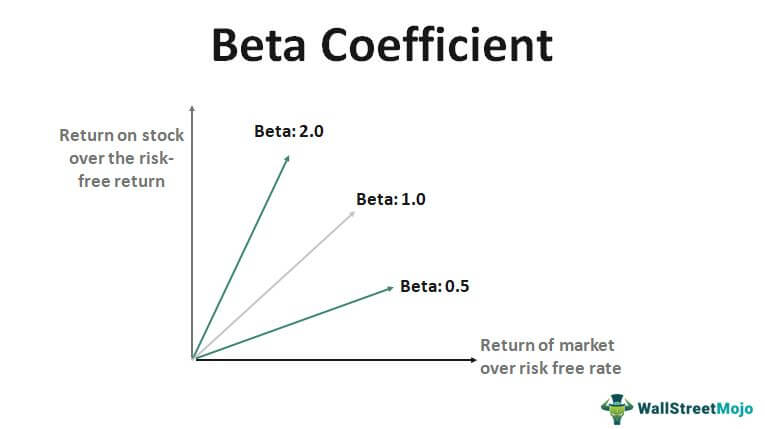

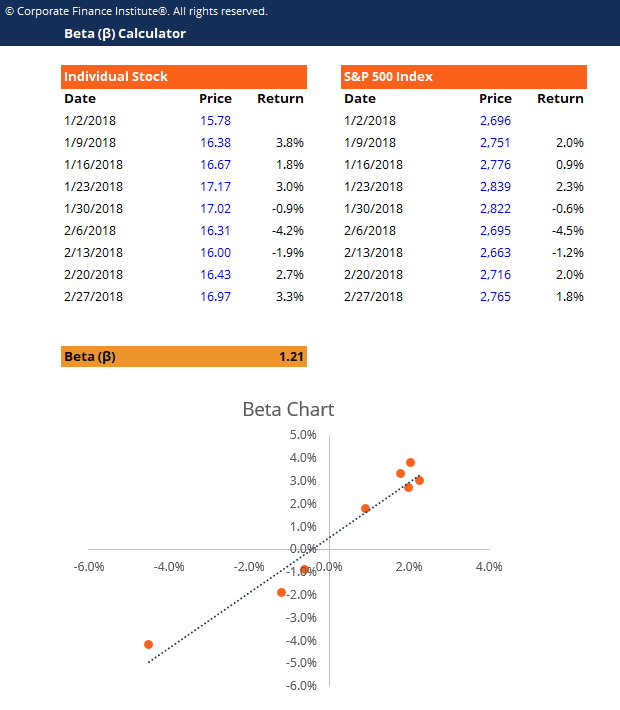

For example if beta is 13 and the market is expected to move up by 10 then the stock should move up by 13 13 x 10. The volatility of the stock and systematic risk can be judged by calculating beta. This content will surely give you an analytical view regarding the top volatile stocks.

Beta is a form of regression analysis and it can be useful for investors regardless of their risk tolerance. As the name already indicates logistic regression is a regression analysis technique. Linear regression is a widely used data analysis method.

When predicting financial statements for a company multiple regression can be useful to see how changes in some expectations or market drivers may affect sales or expenses in the future. The beta of a stock is calculated using regression analysis. However in simple words by calculating beta one can judge the volatility of.

Beta specifically is the slope coefficient obtained through regression analysis of the stock return against the market return. For example a company with a beta of 1 would expect to see future returns in line with the overall stock market. The following regression equation is employed to estimate the beta.

In the above example we have calculated beta using the above steps. Beta can be calculated using the regression analysis. Newey and Kenneth D.

By using our website you can be sure to have your personal information secured. In finance regression analysis is used to calculate the Beta Beta The beta β of an investment security ie. West in 1987 although there are a number of later variants.

Beta is calculated using regression. If you are new to this it may sound complex. If the correlation between two or more regressors is perfect that is one regressor can be written as a linear combination of the others we have perfect multicollinearityWhile strong multicollinearity in general is unpleasant as it causes the variance of the OLS.

Beta in the CAPM seeks to quantify a companys expected sensitivity to market changes. Our regression model gives it a value of 05751 which when rounded off is 058. Stock Rover has the following Beta Calculation.

Return is calculated by dividing the old price and the new price and subtracting one from it and multiplying by a hundred. In this regression model the response variable in the previous time period has become the predictor and the errors have our usual assumptions about errors in a simple linear regression model. Yahoo Finance gives Facebook a Beta value of 058.

You can use a spreadsheet program to plot the dates and returns of your stocks. A stock is a measurement of its volatility of returns relative to the entire market. With these three parameters predict the normal returns for all days of the event window.

Stock Rover our review-winning stock research and analysis screener makes calculating Beta easy. Beta is the key factor used in the Capital Asset Price Model CAPM which is a model that measures the return of a stock. The effect on the predicted probability of a change in a regressor can be computed as in Key Concept 81.

Using a stock screener with powerful financial analysis built-in is the easiest way to calculate complex financial ratios like Beta. It is the only company-specific variable in the CAPM. It will return the slope of the linear regression line through the data points in known_ys and known_xs.

And this is what this post is about. Beta can also be used by investors to evaluate a particular stocks expected rate of return particularly when using the Capital Asset Pricing Model CAPM. In R Probit models can be estimated using the function glm from the package stats.

For instance within the investment community we use it to find the Alpha and Beta of a portfolio or stock. The best fit line to the data is called the regression line. The formula for calculating beta is the covariance of the return of an asset.

It is used as a measure of risk and is an integral part of the Capital Asset Pricing Model CAPM. In this regression model the response variable in the previous time period has become the predictor and the errors have our usual assumptions about errors in a simple linear regression model. The formula for calculating a stocks beta is simple in theorybeta is found by dividing covariance by variance.

Regression analysis is a set of statistical processes that you can use to estimate the relationships among variables. Using regression analysis calculate the alpha beta and sigma coefficients that explicate the typical relationship between the stock and the reference index. It was devised by Whitney K.

Calculate the BETA of MakeMyTrip in Excel using SLOPE and Regression Regression Regression Analysis is a statistical approach for evaluating the relationship between 1 dependent variable 1 or more independent variables. Plot the pairs of stock return data to obtain a scatter plot. These price returns are then used in calculating the slope function.

The final calculation in the cost of equity is beta. If youre interested in taking your skills with linear regression to the next level consider also DataCamps Multiple and Logistic Regression course. But it is in fact simple and fairly easy to implement in Excel.

Also using spreadsheet software you can plot a best fit line. Beta 1-Year Beta 3-Year. Multicollinearity means that two or more regressors in a multiple regression model are strongly correlated.

Any reputable share price information source should suffice we have chosen Yahoo Finance. In Excel this can be calculated using the Slope function SLOPE Function The SLOPE Function is categorized under Excel Statistical functions. The Easy Way to Calculate Beta.

This makes it easier to note the properties of the data. We do not at any time disclose clients personal information or credentials to third parties. In short regression analysis is all about comparing one stable variable with other changing variables.

Step 1 - Calculating beta from a stock. It is widely used in investing financing sectors to improve the products services further. The order of an autoregression is the number of immediately preceding values in the series that are used to predict the value at the present time.

1

Bloomberg Historical Beta Calculation Using Excel Amt Training

Beta Coefficient Meaning Formula Calculate Beta Coefficient

Beta Coefficient Meaning Formula Calculate Beta Coefficient

How To Calculate Beta On Excel Linear Regression Slope Tool Youtube

Visualizing Beta Stock Risk And Market Correlation Seeking Alpha

Linear Regression Finding Alpha And Beta Investment Cache

Beta Calculator Template Download Free Excel Template