This metric is an indicator of the overall financial strength or weakness of a company. Your financial plan might feel overwhelming when you get started but the truth is that this section of your business plan is absolutely essential to understand.

16 Financial Ratios For Analyzing A Company S Strengths And Weaknesses Aaii

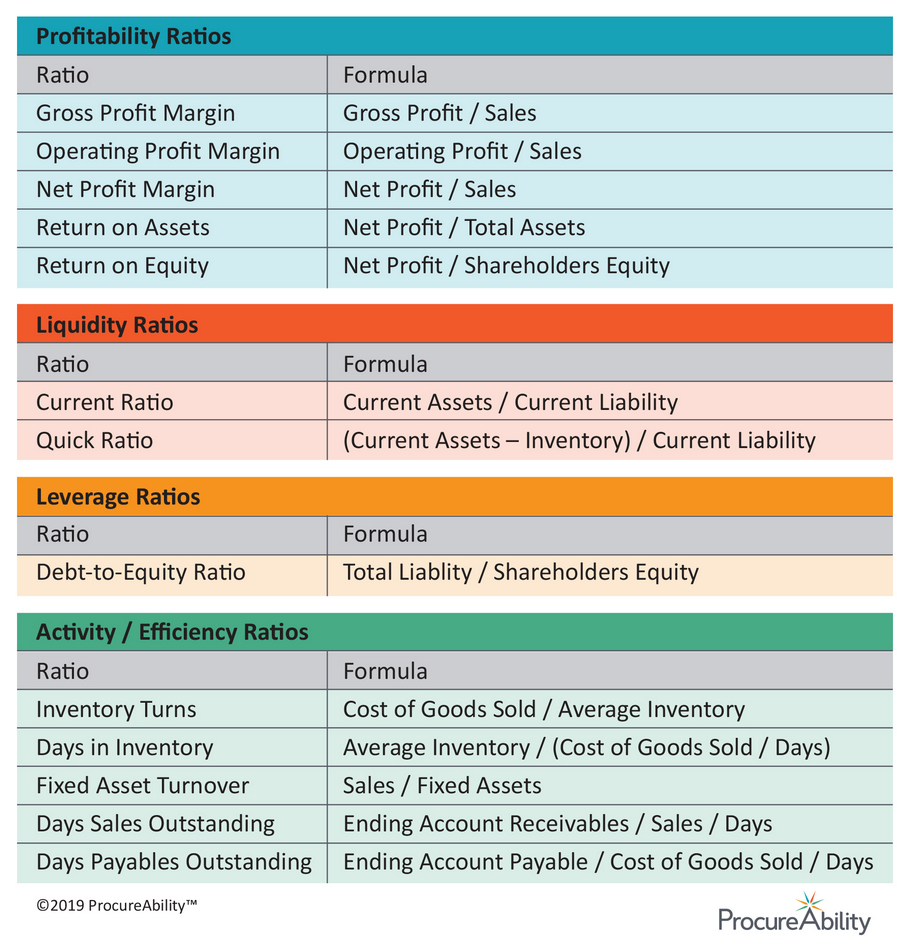

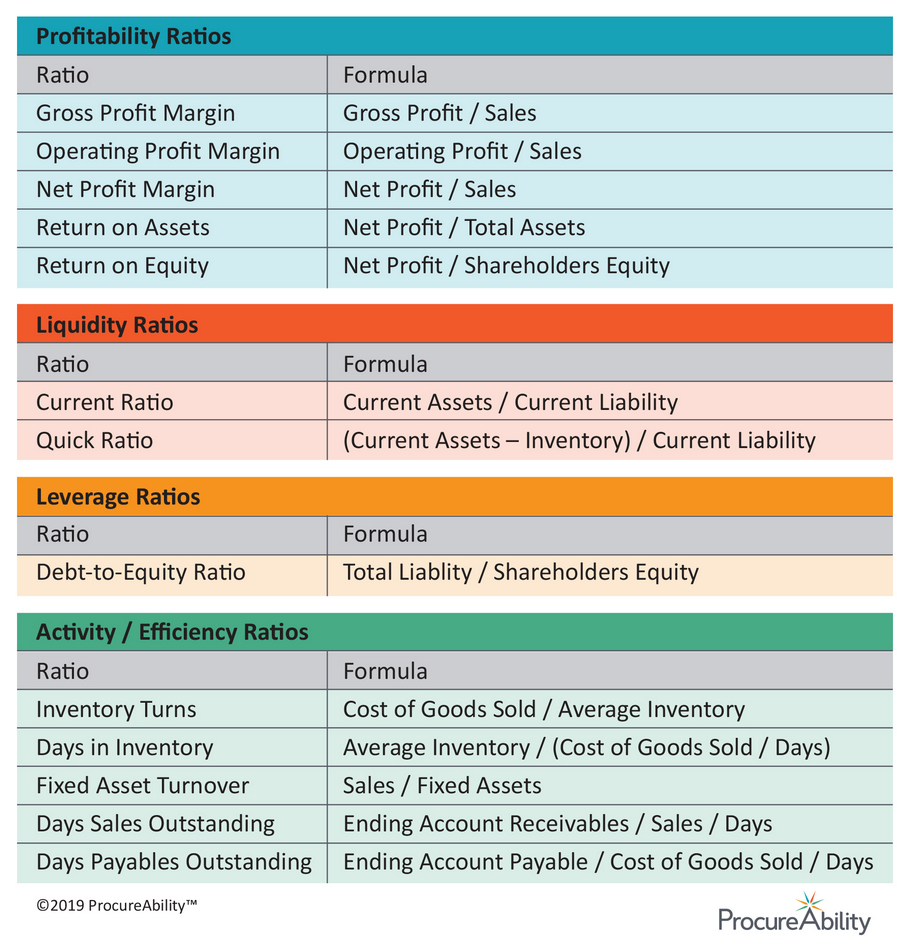

Supplier Financial Analysis For Procurement Professionals Procureability

Debt To Equity Ratio Calculation Interpretation Pros Cons

Financial ratios provide information on a companys financial strength efficiency profitability and other business measurement metrics.

Financial strength ratios. As the name suggests its a more stringent measure of its ability to meet its obligations. The proprietary ratio is the ratio of shareholder funds upon total tangible assets. Her strength lies in simplifying complex financial concepts with real life stories and analogies.

Theyre also used by financial auditors who want insight into a companys financial statements. Quick Ratio. The quick ratio formula for calculation divides a companys liquid assets by its current liabilities.

1 Debt Ratio. Even if you end up outsourcing your bookkeeping and regular financial analysis to an accounting firm youthe business ownershould be able to read and understand these documents and make decisions based on what you learn from them. Operating strength or weakness of the business concern.

These ratios usually measure the strength of the company comparing to its peers in the same industry. The current ratio one of the most commonly cited financial ratios measures the. Liquidity ratios show the ability to turn assets into cash quickly.

Investors and banks use financial ratios to judge the strength of a business. Comparing an individual firms ratios against average ratios for its industry or a group of its competitors provides additional valuable insight. Items on these statements are compared with other items to produce ratios that represent key aspects of the companys financial picture such as liquidity profitability use of debt and earnings strength.

Ratio analysis is used to identify various problems with a firm such as its liquidity efficiency of operations and profitability. Financial Ratios Analysis. Balance sheet ratios are the ratios that analyze the companys balance sheet which indicate how good the companys condition in the market.

Financial ratios are the indicators of the financial performance of companies and there are different types of financial ratios which indicate the companys results. For example a ratio of 11 means you have no working capital left after paying bills. Uses of Financial Statement Analysis O identify major changes or turning points in trends amounts and relationships O yield valuable information about trends and relationships the quality of a companys earnings and the strengths and weaknesses of its financial position O assessment of past performance and current position O assessment of future potential and related risk.

Balance sheet ratios evaluate a companys financial performance. It tells about the financial strength of a company. Financial strengthsolvency of a company.

However they can be just as useful for small business owners. Capital Intelligence CI has been providing credit analysis and ratings since 1985. So generally the higher the ratio the better off your business will be.

Its also known as the acid test. Debt ratings assess a companys prospects for repaying its debts and assist lenders in setting interest rates and terms for a companys commercial paper loans bonds etc. As Investopedia defines them Key ratios take data from the subject companys financial statements such as the balance sheet income statement and statement of cash flows.

The author is a Certified Financial Planner CFP with 5 years experience in Investment Advisory and Financial Planning. Solvency ratios show the ability to pay off debts. Liquidity solvency and profitability.

It proves to be a prerequisite for analyzing the businesss strength profitability scope for betterment. There are three types of ratios derived from the balance sheet. Capital Intelligence rates over 400 Banks Corporates and Financial Instruments Bonds Sukuk in 39 countries.

It subtracts inventory from. Guide to Financial Ratios While some businesses are proud to be debt-free most companies have at some time borrowed money to buy equipment build new offices andor issue payroll checks. 1 Liquidity 2 Solvency 3 Profitability 4 Financial Efficiency and 5 Repayment Capacity.

It is the number of times a companys current assets exceed its current liabilities which is an indication of the solvency of that business. These statements are useful to management investors creditors bankers. It is also used to identify the positives or strengths of a firm.

Balance Sheet Ratios Formula and Example Definition. This ratio is a good measure of the financial strength of your business. The debt ratio gives a comparison of a companys total debt.

Ideally the ratio should be 13. The quick ratio is another way of helping you pinpoint a companys financial strength. Financial Ratios Types Meaning Formulas.

The current ratio is a reflection of financial strength. Its interpretation is similar to that of the McClellan Oscillator except that it is more suited to major trend reversals. Claims-paying andor financial strength ratings assess an insurers ability to meet its financial obligations to policyholders.

Thats where knowing the best financial ratios for a small business to track comes in. Whilst there are countless ratios quoted by finance analysts and most have their uses for the purpose of this fact sheet the focus will be on 17 ratios covering 5 key areas of the business being. Here is the formula to compute the current ratio.

Financial leverage ratios Profitability ratios Efficiency ratios. The following ratios are used to analyze the financial liabilities. More Technology Sector historic financial strength information Quick Ratio Comment On the trailing twelve months basis Technology Sector s Cash cash equivalent grew by 385 in the 3 Q 2021 sequentially faster than Current Liabilities this led to improvement in Technology Sectors Quick Ratio to 108 in the 3 Q 2021 Quick Ratio remained below Technology Sector average.

Profitability ratios show the ability to generate income. More Airline Industry historic financial strength information Quick Ratio Comment On the trailing twelve months basis Due to increase in Current Liabilities in the 3 Q 2021 Quick Ratio fell to 093 above Airline Industry average. Ratio analysis is the comparison of line items in the financial statements of a business.

The McClellan Summation Index MSI is a breadth indicator which is calculated as a running total of the McClellan Oscillator values.

Calculate Financial Strength Ratios Online Investing Hacks Book

Vietnam S Banks Raise Foreign Ownership Ratio To Improve Financial Strength The Star

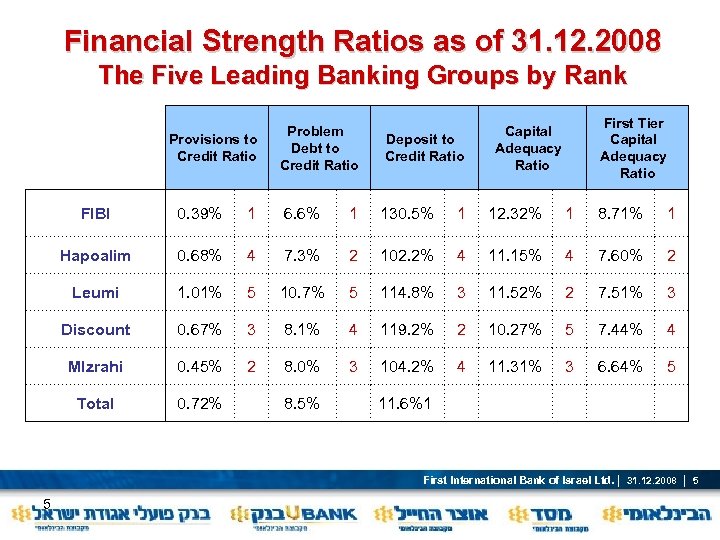

First International Bank Of Israel Ltd Fibi

Pearl And Camel Pdf Market Liquidity Credit Finance

6 Important Financial Ratios For Investors Fairmont Equities

Financial Ratio Analysis How To Interpret Ratios To Analyse A Company Getmoneyrich

Analysis Of Financial Statement Of A Business Solved Examples Of Financial Ratios

Finding Value And Financial Strength Based On What Works On Wall Street Aaii